iowa capital gains tax on property

100 acres in Iowa. Federal capital gains tax rate.

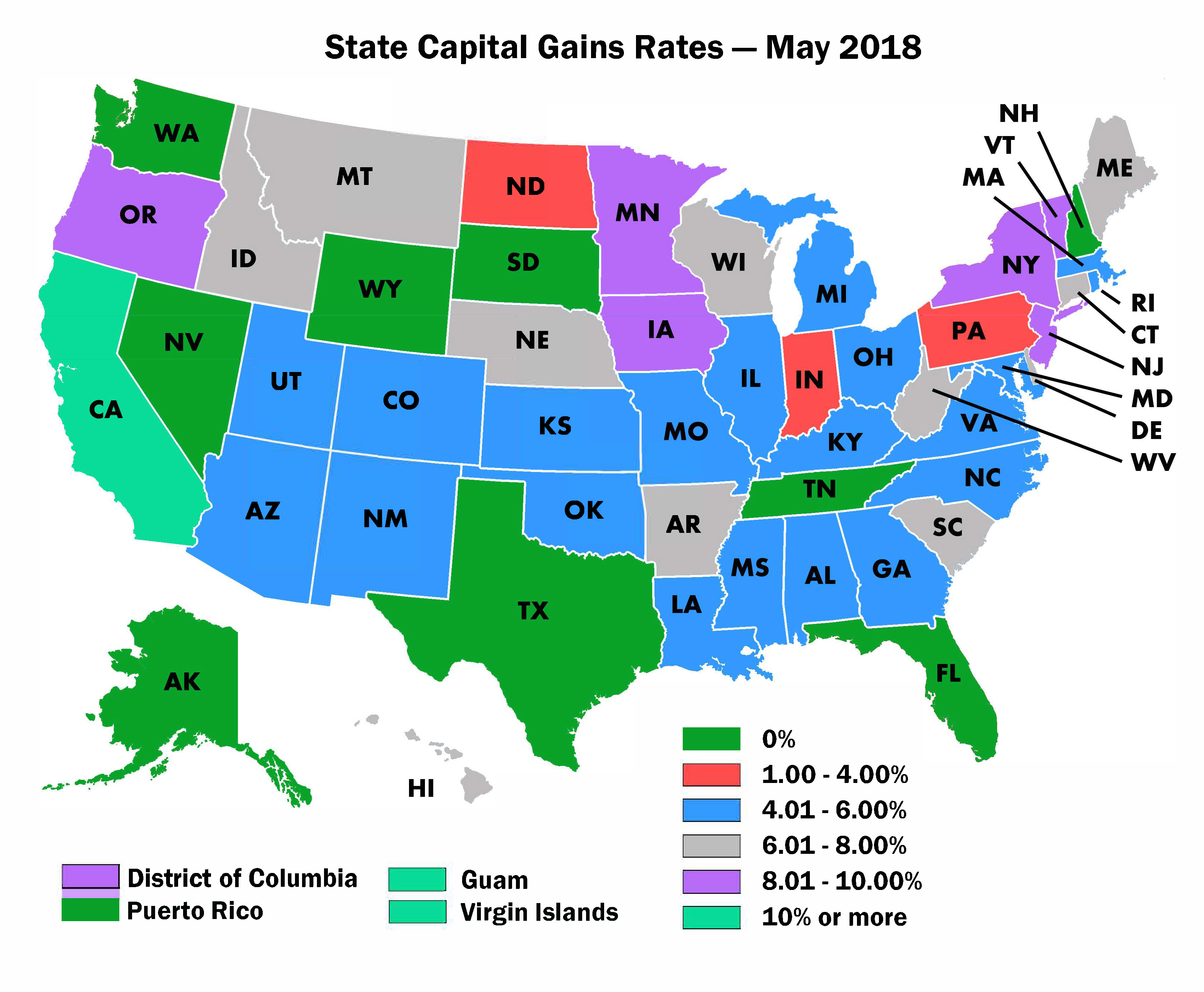

2022 Capital Gains Tax Rates By State Smartasset

File a W-2 or 1099.

. The Iowa capital gain deduction is available for the net capital gain from qualifying sales of the following properties. 15 flat rate Iowa capital gains tax rate. Not all states impose a state tax on capital gains.

Learn About Property Tax. The tax rate on most net capital gain is no higher than 15 for most individuals. Capital Gains Tax 2021 In Iowa with Ingredients and Nutrition Info cooking tips and meal ideas from top chefs around the world.

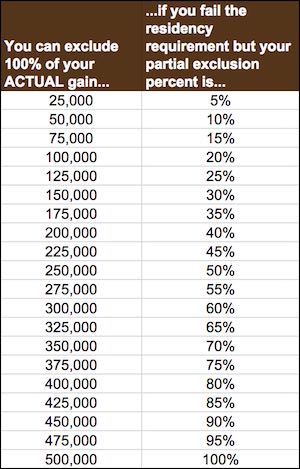

You can sell your primary residence exempt of capital gains taxes on the first 250000 if you are single and 500000 if married. Some or all net capital gain may be taxed at 0 if your taxable income is less than 80000. Capital GAINS Tax.

Should the Department request it the information on the Capital Gain Deduction. Iowa is a somewhat different story. The document has moved here.

The law modifies Iowa Code 4225 3 b to lower the top rates as follows. Gains from the sale of stocks or bonds DO NOT qualify for the deduction with the following exception. Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined.

The table below summarizes uppermost capital gains tax rates for Iowa and neighboring states in 2015. Effective with tax year 2012 50 of the gain from the saleexchange of employer. In fact the same income tax rates apply to all Iowa taxable income whether stemming from ordinary income or a capital.

For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction. Appraised fair market value. If an individual or.

Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay. You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return. Rule 701-4038 - Capital gain deduction or exclusion for certain types of net capital gains For tax years beginning on or after January 1 1998 net capital gains from the sale of the.

Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two. Learn About Sales. The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue and must be reported on an Iowa Capital Gain Deduction IA 100 form.

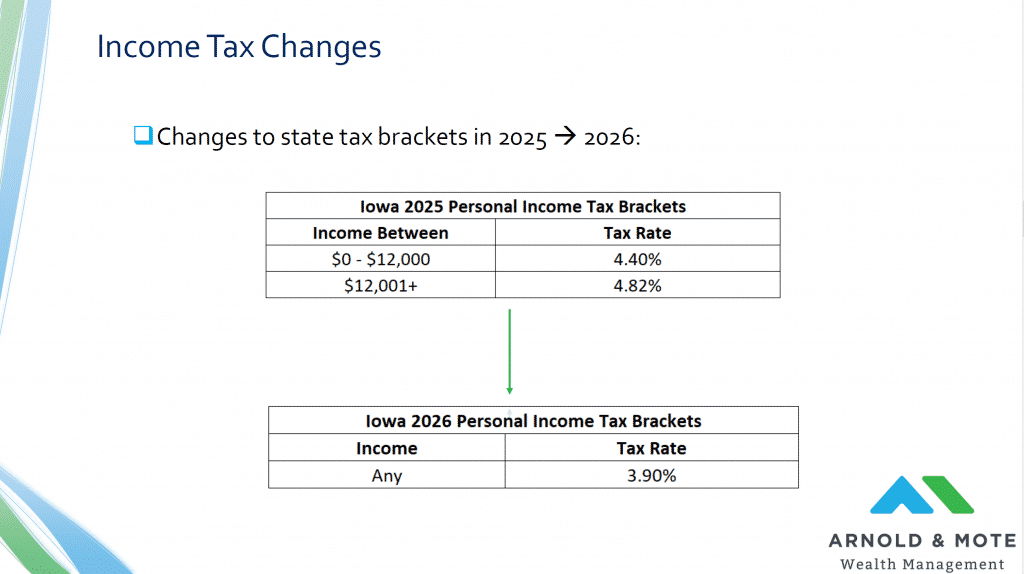

Iowa however does. Cattle Horses and Breeding Livestock A taxpayer may deduct the net. 2023 6 percent graduated 2024 57 percent graduated 2025 482 percent graduated 2026 and.

Iowa has a unique state tax break for a limited set of capital gains. When a landowner dies the basis is automatically reset to the current fair. 1 week ago In the case of installment sales of qualifying.

Toll Free 8773731031 Fax 8777797427. The most basic of the qualifying elements for the deduction requires the ability to count to 10 or. Individuals earning 40400 445850 and married couples earning 80800 501600 pay a capital gains tax rate of 15 on long-term capital gains.

This exemption is only allowable once every two years. CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including. The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form.

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Iowa tax law provides for a 100 percent deduction for qualifying capital gains. Before you complete the.

What is the Iowa capital gains tax rate 2020 2021.

Capital Gains Tax Calculator Estimate What You Ll Owe

Understanding Capital Gains Tax On Real Estate Investment Property

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

Iowa Republicans Weigh Ending State Income Tax But Hurdles Remain

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

For Home Sellers Capital Gains Tax 101 Deeds Com

Details On The Iowa Inheritance Tax Repeal Beattymillerpc Com

Capital Gains Tax Calculator Estimate What You Ll Owe

Capital Gains Tax Iowa Landowner Options

Cutting Taxes For All Iowans Office Of The Governor Of Iowa

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

How Do State And Local Individual Income Taxes Work Tax Policy Center

1031 Exchange Iowa Capital Gains Tax Rate 2022

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Paying Capital Gains Tax In Iowa Stocks Cryptocurrency Property

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Iowa Capital Dispatch

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep